Genesis - Chapter 11

"That is why it was called Babel—because there the Lord confused the language of the whole world"

In the Bible, Chapter 11 of Genesis is really about the fall of Babel.

In Crypto, perhaps we are really living in a simulation - The incoming chapter 11 bankruptcy proceedings of Genesis will start with the fall of Babel.

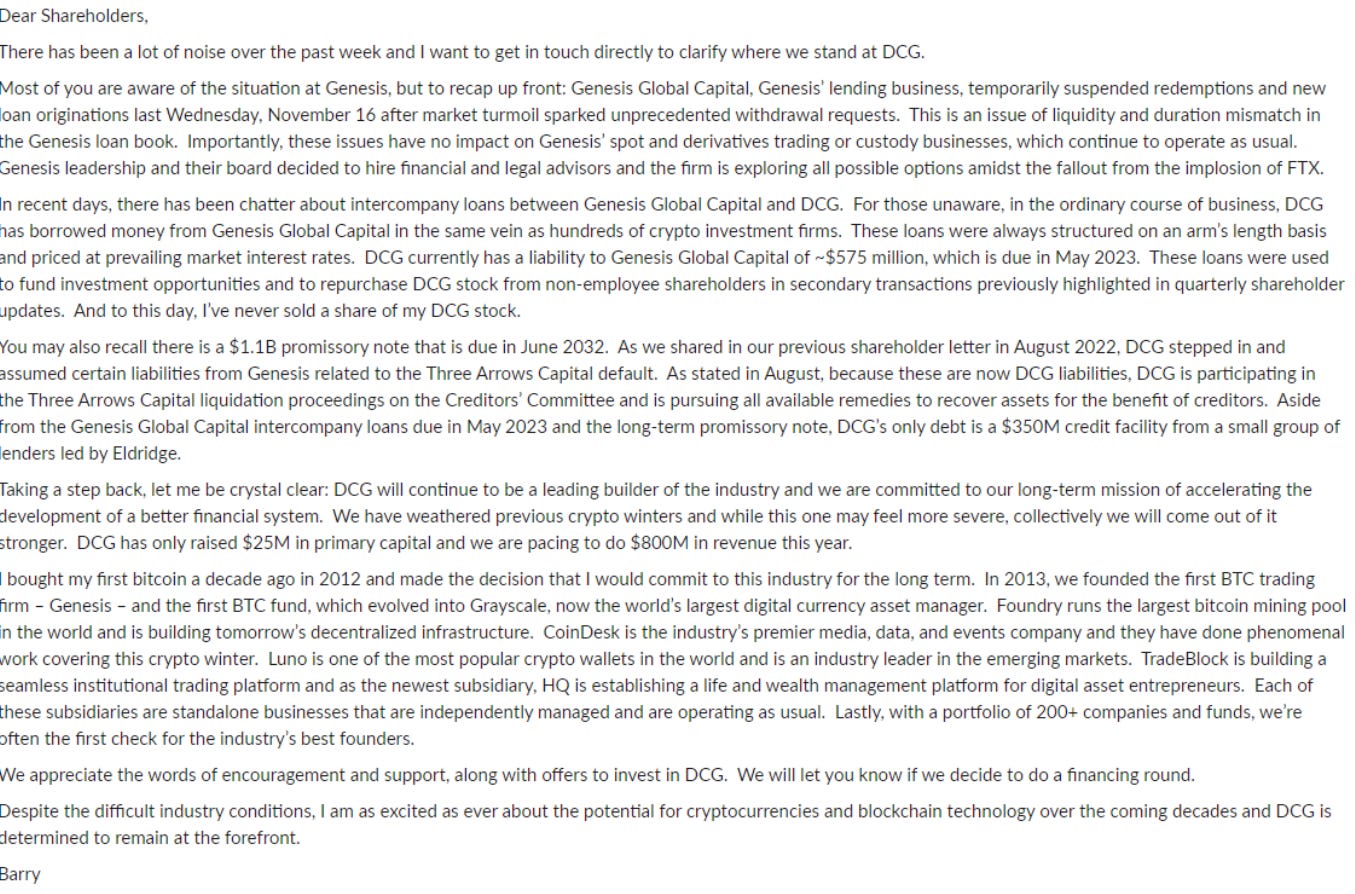

Given Barry’s letter today, it is extremely likely for DCG and Genesis to go under. DCG might be able to survive through some sheer legal wrangling but it is not possible for Genesis to escape unscathed.

From this, we can take away a few points.

First off - DCG in aggregate owes 2.025 bn. They owe 1.675bn to Genesis and 350m to external creditors.

This looks extremely bad. Worse than I ever thought.

Part 1 - Genesis

Let’s explore Genesis. First of all, the crown jewel of Genesis was it’s lending business. Alas, the fall of Babel, 3AC and FTX tore a massive hole in its capital structure.

Genesis owes a lot of money. It probably has no net equity at this point. BBG reports that Genesis has ~2.8bn of outstanding loans. As a lender these loans are “assets”. Deposits to Genesis are “liabilities”.

Like what Barry mentioned in his letter, DCG gave a 1.1bn note to take over 3AC’s liabilities to Genesis (Since 3AC was a borrower, those loans were an asset on Genesis books, until it went poof). In order to plug the hole and prevent themselves from going insolvent, they conjured up a note.

Honestly, financial trickery. Unless DCG pays back the money - Genesis’s balance sheet looks more like this

This means that depending on how much DCG has to repay Genesis back - Genesis creditors have a recovery of about 40cents on the dollar.

This hole was created from 3AC’s default - causing a 1.1bn loss on Genesis. Someone will bear this loss. Whether it is DCG or Depositors/Creditors of DCG.

Risk and Money follows the second law of thermodynamics. They can be shuffled and transferred around - but they cannot magically disappear.

Given that Genesis’s money comes from creditors/depositors - you can be sure that they WILL chase down DCG for the money.

Part 2 - DCG

Given that DCG actually had to take a 575m loan from Genesis to buy back stock, we can probably assume that they don’t have much cash on hand. But they do have tons of GBTC

What were they doing? Probably the same as everyone - Buying the dip

Except the dip kept on dipping.

What are Barry’s options now? Remember - he owes 2bn

(1) Raise money somewhere somehow (obviously this failed)

(2) Sell Grayscale

(3) Sell all his GBTC

(4) Apply to the SEC for Reg M relief and convert his GBTC into BTC and sell it out

(5) Unwind GBTC

Let’s explore.

Option 2 - Selling Grayscale

At it’s peak, DCG was able to raise at a valuation of 10bn in Nov 21 - in a round led by Softbank.

Well, that lead investor now has no more money as well.

What were it’s earnings like then?

Grayscale’s 2 biggest trusts/money makers were GBTC and ETHE.

GBTC had ~633,394 BTCs. At 2% of mgmt fee, that would work out to be 874m at 69k BTC prices.

ETHE had ~3.04M of ETH. At 2% of mgmt fee and 4.8k ETH, that would be 292m of fees.

In aggregate for 2021, at peak prices - Grayscale probably was doing 1.166bn in revenues. Earnings would probably be very close given you literally had to do nothing.

Genesis was touted to have made ~1bn in earnings last year.

Total earnings ~2bn

This means that in Nov 21, at the peak of the bull market - DCG could only command a 5x PE at best. If we were to add in the rest of the bells and whistles like the venture portfolio, that makes the PE it could command even worse.

Grayscale business

So how much should the Grayscale business be valued at now?

Let’s figure out the easy part which is the expected revenues for this year.

At 16,500 BTC prices and 1160 ETH price -

GBTC should fetch in 209m and ETHE should fetch 70.6m - In aggregate ~279.7m

What about the P/E ratio?

First - Both GBTC and ETHE have direct crypto delta. i.e if BTC were to puke to 1.6k, expect mgmt fees to get slashed by 90% as well.

Secondly - Post FTX, much of the institutional world have been entirely disgraced and tainted. Any CIO recommending crypto exposure is taking on real career risk.

If in a bull market, DCG could only fetch 5x PE. I expect that in current distressed conditions, Barry can only probably find investors bidding at 2x PE or less.

Which means that the Grayscale business could potentially fetch only 560m to 840m.

This is very short of 2.02bn

Option 3 - Selling GBTC into the market

This will probably only manage to raise 565m at best. Assuming all 67m~ of shares get transacted into the market without slippage.

Given that this is 10% of the outstanding shares, highly unlikely for the slippage to be so low. There are less buyers for GBTC than for BTC.

It is more likely for them to only be able to raise about ~300m with this.

Option 4 - Go hand in hat to the SEC and apply for Reg - M relief

Approaching the SEC for Reg M relief could allow DCG to take their ~67m shares of GBTC and redeem it in kind for BTC. This will allow them to access about 61k of BTC.

If they sell this into the market, it will raise about 1bn in cash. Assuming they manage to get a price of 16500.

To be honest, 61k of BTC is a lot. But its not that bad. They can probably get filled in total at about 14k.

That works out to be about 858m.

However, there is CLOSE TO ZERO CHANCE that the SEC will allow this to happen.

The optics for the SEC to do this is terrible. Reg M relief essentially means for DCG to be able to dump ahead of everyone else. Rules for Thee but not for me.

Given that Barry has not donated much money, neither does he has any obvious links with Gensler and the bad blood with the SEC on the ETF redemption - I doubt the SEC would lend a hand at their own public image expense.

Option 5 - Unwinding GBTC

By unwinding GBTC, everybody will be able to get out. That is the apocalyptic scenario for BTC with 633k of BTC hitting the market.

The only way there is sufficient dollars in the system to bid this is if the prices goes low enough. The last BTC will probably clear at 8k with an average selling price of 12k in an optimistic scenario.

Not entirely that bad. DCG will get to raise ~750m of cash.

Also it keeps ETHE and the rest of its other businesses.

What goes?

If Barry unwinds GBTC - there will probably NOT be a buyer for Grayscale at those valuations because GBTC is the main driver of revenues.

Choosing to sell Grayscale and GBTC into the market will net him anywhere from 700m to 1.1bn

Choosing to unwind GBTC will probably net him 750m

Whatever the choices - these will not be enough to raise 2bn and be able to repay Genesis.

This means that Genesis will collapse. “That daisy chain of leverage” isn’t looking so good now is it?

Part 3 - Genesis as a middle man

The collapse of Genesis will probably shutter more institutional funds. While recovery looks higher than FTX, the problem with Chapter 11 is that it is a long and drawn out process. Which means those money will be sequestered away from the crypto ecosystem.

Funds with exposure to Genesis will take a hit - shortly after FTX gave them a punch in the face.

My predictions

1 - We will see a wave of LP redemptions into 2023 - this will lead to most institutional capital exiting the space entirely.

2 - Prolonged pain as crypto capital is locked up in the bankruptcy courts

3 - Contagion into the exchanges. The weaker ones will go under.

4 - Venture funds will take a 95% mark down in all their assets as excesses are flushed out of the system

Conclusion

Regardless of what DCG does, the hole for Genesis is probably too big to be filled. Genesis will probably file for bankruptcy and go under with direct contagion into the ecosystem as it was the institutional prime broker for the space.

DCG will likely sell their GBTC - whether in the stock market as GBTC shares or in an apocalyptic scenario of unwinding the trust and selling it as BTC.

Unwinding the trust will result in 633k of BTC hitting the market. Selling it as GBTC shares will probably result in an equivalent of 30k of BTC sell pressure into the spot market as the stock market absorbs the flow.

633k BTC * $12000 doesn't equals 7,596,000,000 ($7billion).

Or I missed something

Great work as always. Liabilities' maturity dates structure may play a role and may buy DCG a material amount of time...